Merkur Bank (XETR: MBK)

Merkur Bank (MBK) is a small regional bank located in Munich, Germany. In 1986, MBK was acquired by a group of private investors led by Mr. Siegfried Lingel. At this time MBK had total assets of €14 million and 7 employees. Mr. Lingel refocused the bank’s business on financing residential real estate developers in Leipzig, Berlin and, to a lesser extent, Munich. In 1995, the bank extended its business to the financing of leasing companies and SMEs. In 1999, MBK went public on the Munich stock exchange. In 2002, Mr. Lingel’s son, Mr. Marcus Lingel, joined the company’s management team and, after a six-year transition phase, he finally became CEO. Mr. Lingel refocused MBK’s real estate business to Munich (beginning in 2002) and, in 2005, to Stuttgart. MBK operates five branch offices and since 2009 the company has also been offering online retail banking solutions to its clients. Currently, MBK has total assets of approximately €1 billion and 200 employees.

The following are the main arguments for investing in the company:

- MBK’s business model is easy to understand.

MBK could serve as a text book example of how banks used (?!) to operate. MBK collects deposits from its clients and uses these funds to provide loans to real estate developers, leasing companies and SMEs. The difference between the cost of taking in clients’ deposits and the interest rate MBK demands from its borrowers is MBK’s most important revenue stream. The second revenue stream are commissions earned by providing various consulting services to clients and borrowers.

MBK is not engaged in any sort of proprietary trading or investment banking. This allowed MBK to survive the financial crisis of ’08-’09 and the “Euro crisis” unscathed because it did not have to record any write-downs. In fact, MBK has been profitable during these times of financial turmoil. MBK also refrains from performing maturity transformation as far as possible.

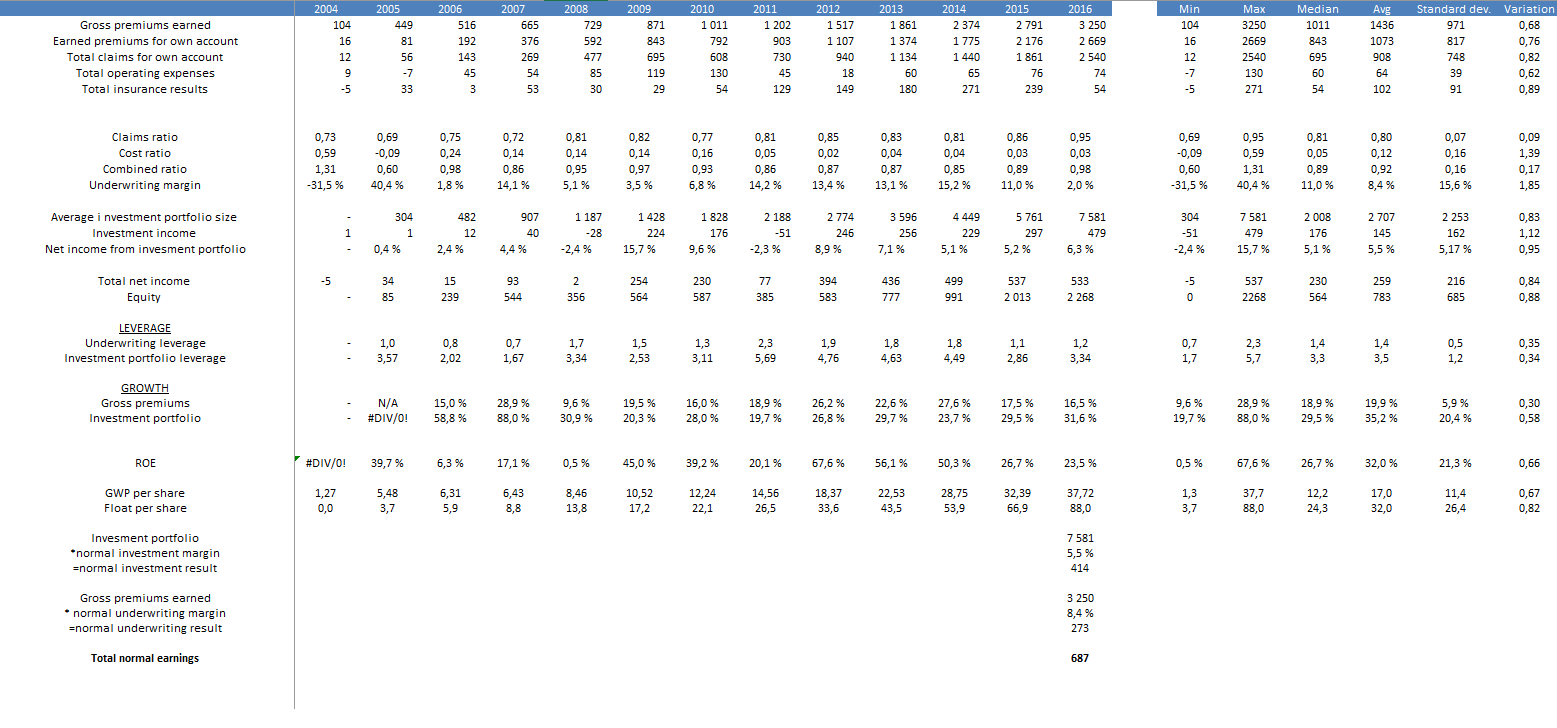

MBK’s business model, i.e. focusing on the “traditional” banking business, makes the bank quite insensitive to the prevailing low interest rate environment. From 2009 to 2016 the bank’s interest rate spread fluctuated between 3.24% (2010) and 2.78% (2016) and the average (= median) interest rate spread being 2.92%. The main factor affecting MBK’s profitability are competitive pressures, i.e. when its competitors demand lower interest rates on new loans to gain market share. These pressures have intensified in the last three years, as the interest rate spread declined from 2.94% to 2.78% (2016).

- Focus on Munich’s housing market should provide potential for further growth.

MBK’s most important business segment is real estate financing and, here, the bank is particularly focused on Munich.

Munich is an attractive city for real estate developers because of a chronic scarcity in housing. This situation will probably not change as Munich’s population is likely to grow in the future, as it has done in the past. This is due to the high quality of living the city offers (it constantly ranks among the top ten cities in the world) and its …

Read more