Investing Questions

Comment below any sort of question(s) related to investing to get a direct answer from Geoff.

… Read moreSessions with Geoff

[ecwd id=”2135″ type=”full” page_items=”5″ event_search=”yes” display=”full” displays=”full,list,week,day” filters=””]

As a member, you can book a session with Geoff over skype to ask him anything about investing one-on-one. Comment below on what slot you’d like and Geoff will reach out to you. First-come, first-serve.

…

Read moreDo Supermarket Stocks Have Long-Term Staying Power?

Read the Free Report on Village Supermarket

Following Amazon’s acquisition of Whole Foods and the big drop in supermarket stocks – especially Kroger (KR) – I’ve decided to do a series of re-posts of my analysis of the U.S. supermarket industry.

Today’s re-post is a roughly 1,300 word excerpt from the Village Supermarket (VLGEA) stock report Quan and I wrote back in 2014. This section focuses on whether or not a supermarket can be a durable investment. The full 10,000+ word report on Village – along with 26 other reports of similar depth – are now available at my new site, Focused Compounding.

Some facts have changed since this report was written. For example, Amazon’s companywide sales figure is much, much higher than it was in 2013 (the last year for which we had data when we wrote this report).

And – more relevant to the grocery industry – Amazon Fresh has gone from a $300 a year add-on to Amazon Prime to a $15 a month add-on to Amazon Prime (so 40% cheaper).

Durability (From the 2014 Report on Village Supermarket)

High Volume Supermarkets are Durable Local Market Leaders

Demand for food is stable. Most grocers do not experience meaningful changes in real sales per square foot over time. Changes in real sales numbers almost always reflect changes in local market share. There will be online competition in the grocery business. However, in Village’s home market of New Jersey, direct to your door delivery of groceries has been available for 18 years. Peapod started offering online grocery shopping in 1996. The company was later bought by Royal Ahold. Royal Ahold owns Stop & Shop. Peapod has 4 locations in Somerset, Toms River, Wanaque, and Watchung. These locations offer grocery delivery in Village’s markets. They are direct competition and have been for years. Peapod does not require a $300 annual fee like Amazon Fresh. Instead, Peapod simply adds a delivery charge. Customers also tip the driver. Since the driver normally carries the bags into the customer’s home and puts them on the kitchen counter for the customer – the tip is usually a generous one. Peapod charges $6.95 for orders over $100. The charge for orders under $100 is $9.95. The minimum order size is $60. Customers can also order online and then drive to one of the 4 Stop & Shops mentioned above (Peapod often uses the second floor of a building where the ground level is Stop & Shop’s retail store) and pick up their own order. Pick-up is free. However, a Peapod employee still collects the groceries and brings them to the customer’s car. So, a tip is still expected. Common tips are probably $5 to $10. So, the total cost of a Peapod home delivery order is probably anywhere from $12 to $20 higher than a trip to a Stop & Shop grocery store. Even a pick-up is probably $5 higher than a normal Stop & Shop visit – …

Read moreSupermarket Stocks Down: Start Your Industry Research with a Free Report on Village Supermarket (VLGEA)

Read the Free Report on Village Supermarket

Kroger (KR) is down 11% today. The stock’s P/E is now about 11.

Kroger is guiding for same store sales of flat to up just 1% this year. This guidance – combined with Amazon’s purchase of Whole Foods – is probably why the stock is down.

Supermarket stocks are a good area for value investors to research now. One way to learn about the supermarket industry in the U.S. is to read the report Quan and I wrote on Village Supermarket (VLGEA) back in 2014.

That stock is now at roughly the same price – $25 a share – it was when we wrote about it.

A membership to my new site, Focused Compounding, gives you access to this report on Village Supermarket as well as 26 other stock reports just like it.

A membership to Focused Compounding costs $60 a month. If you enter the promo code “GANNON” at sign-up, you will save $10 a month forever.

Read the Full Report on Village Supermarket…

Read moreA Blast from the Past: Warren Buffett’s 1977 Shareholder Letter

Whenever someone comes to me asking for advice on how to get started in investing, the first place I direct them to is reading all Warren Buffett’s Berkshire shareholder letters. It is no secret that his letters have tons of golden investing-wisdom nuggets laid upon them. I have read them many times but interestingly enough, I always take something new away from them every time I reread them. In this series, we’re going to go all the way back and start from the beginning and review all of Berkshires’ Investor letters and all the significant passages, starting with 1977; a cool 19 years before I was born.

Focus on Return on Invested Capital, instead of EPS growth

“Most companies define “record” earnings as a new high in earnings per share. Since businesses customarily add from year to year to their equity base, we find nothing particularly noteworthy in a management performance combining, say, a 10% increase in equity capital and a 5% increase in earnings per share. After all, even a totally dormant savings account will produce steadily rising interest earnings each year because of compounding. Except for special cases (for example, companies with unusual debt-equity ratios or those with important assets carried at unrealistic balance sheet values), we believe a more appropriate measure of managerial economic performance to be return on equity capital. In 1977 our operating earnings on beginning equity capital amounted to 19%, slightly better than last year and above both our own long-term average and that of American industry in aggregate. But, while our operating earnings per share were up 37% from the year before, our beginning capital was up 24%, making the gain in earnings per share considerably less impressive than it might appear at first glance. We expect difficulty in matching our 1977 rate of return during the forthcoming year. Beginning equity capital is up 23% from a year ago, and we expect the trend of insurance underwriting profit margins to turn down well before the end of the year. Nevertheless, we expect a reasonably good year and our present estimate, subject to the usual caveats regarding the frailties of forecasts, is that operating earnings will improve somewhat on a per share basis during 1978.”

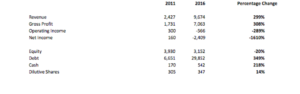

Warren is talking about looking through the noise and thinking about how a business has gotten to present day. What does Warren mean by this? Well, let’s look at a disastrous investment example to illustrate.

Valeant was the darling of Wall Street for quite some time, and everyone reading this blog will be familiar with what happened to them. The most alarming thing for me when I did some due-diligence on Valeant when it was in the $200’s, was their exploding debt followed by declining operating/net earnings… A true recipe for disaster. Growing revenue is good, but you want to understand how they got to where they are. The whole Valeant saga was, and still is, a case study in action. Standing from the sidelines, I have …

Read moreWells Fargo (NYSE:WFC)

OWNERSHIP: I first bought WFC in FEB-2010. It is my top holding at 12.5% of my portfolio.

Figures as of 24-APR-2017

SUMMARY

Wells Fargo is one of the biggest banking / financial institutions in the United States. The company is organized into three operating segments: Community Banking which offers a complete line of financial services for consumers and small businesses (representing ~50% of earnings); Wholesale Banking which offers banking to larger businesses and government institutions (representing ~35% of earnings); and Wealth and Investment Management which offers personalized wealth management, investment, and retirement products (representing ~10% of earnings).

In general, Wells Fargo makes money in two ways. Firstly, it earns a spread on its interest-earning assets by borrowing at low rates and lending at higher ones. Secondly, Wells Fargo collects fees for the products and services it offers (non-interest income). Non-interest income only partially offsets the company’s non-interest expenses; thus, it is only accretive to earnings if it outpaces costs.

Keys to banking include profitability as measured by Return on Assets (ROA), deposit growth, and leverage. Return on assets is dependent on the cost of a bank’s interest-earning assets (primarily the size of their low-cost and non-interest bearing deposit base), the quality of the loans it makes (the frequency of loan defaults), its ability to generate non-interest income (earn fees for products and services), and its ability to keep costs down (low overhead). Deposit growth translates into higher earnings by increasing a bank’s low cost deposit base and allowing it to earn a spread on additional loans. Leverage is important because it can magnify both earnings and losses.

I believe Wells Fargo securities represent a safe investment. U.S. banks are very durable businesses with high customer / deposit retention. Most American consumers and businesses use their bank accounts for transactions and are generally indifferent to interest payments on the money they use month-to-month. Banks could change for the worse, but changing for the better is much more likely. Traffic to branches is declining, which should lead to branch closures and cost reductions. Wells Fargo has a strong competitive advantage built on a strong branch network, huge base of low cost deposits, conservative lending practices, and an ability to increase non-interest income by cross-selling its products. Wells Fargo serves one-third of American households and its deposit base accounts for 10.8% of all U.S. deposits. Credit has seldom been a problem; the bank successfully navigated severe real estate downturns in California (its largest market) in 2009, and the early 1990s, and there are no signs that the company has become a more aggressive underwriter. The bank has earned a positive net income in each of the last 58 years (as far as I went back) and is less exposed to the risky investment banking and trading business than its peers. The improper sales practices that occurred in Community Banking are the biggest concern because they have tarnished the bank’s reputation and suggest a problem with the bank’s culture; however, if the company implements …

Read moreUnder Armour (UA): A Peek at 2037

Overview

Under Armour (UA) was founded in 1995 by Kevin Plank, then special teams captain of the football team from University of Maryland. Frustrated by the increase in weight traditional cotton T-shirts incur after heavy sweating, Plank set out to develop T-shirts using better materials. After a year of fabric and product testing, he settled on a compressed synthetic shirt that can be worn beneath an athlete’s uniform. The product provides a snug fit, while wicking sweat away from the body and remaining light.

Fast forward 20+ years later, UA has seen its product offering expanded to a wide variety of apparel, footwear, accessories and so on for both men and women. UA also now sells its products globally. In 2016, UA’s revenue has reached more than $4.8 billion, becoming the third biggest sports brand in the world after growing revenue 38% p.a. since 2002. They have also started cracking the lifestyle sportswear market in 2016 by introducing a new product line called UAS.

Despite, the diversification of product lines since its inception, it’s important to remember UA is still a performance wear company. All its products are designed to have an aspect of “performance”, including the new UAS line.

Business Description, Quality and Moat

It’s probably most helpful to understand UA in the context of its two biggest competitors.

Both Nike and Adidas started out as sports footwear companies. As of 2016, both of them still generate the majority of their revenue from footwear, 53% for Adidas and 65% for Nike.

And as brands with longer histories, both Nike and Adidas are more established internationally, generating more than 50% of their revenue outside of their home markets, i.e. Western Europe for Adidas and North America for Nike.

On the other hand, UA is much less reliant on footwear while much more reliant on its home market. With its roots in performance apparel, apparel still represented 67% of revenue for UA in 2016, with footwear at just 21%. UA’s reliance on its home market is more extreme. North America accounted for 83% of their revenue in 2016.

Despite the above two major differences, UA has displayed a remarkably similar financial profile when compared to either Nike and Adidas. First of all, all three of them have stable gross margins in the mid to high 40%. In fact, UA’s gross margin has been higher and more stable since 2002.

Stats for Gross Margin since 2002:

|

Company |

Average |

Median |

S.D. |

Coefficient of Variance |

|

Under Armour |

48% |

48.2% |

1.6% |

0.033 |

|

Nike |

44.1% |

44.5% |

1.9% |

0.042 |

|

Adidas |

47.1% |

47.7% |

1.7% |

0.036 |

A similar picture can be found for EBIT. This time, UA’s performance has only trailed Nike.

Stats for EBIT since 2002:

|

Company |

Average |

Median |

S.D. |

Coefficient of Variance |

|

Under Armour |

10.8% |

10.8% |

1.7% |

0.160 |

|

Nike |

13% |

13.1% |

0.9% |

0.070 |

|

Adidas |

8% |

7.8% |

1.4% |

0.177 |

The major reasons why these three companies can have high and stable gross margins are: 1) They are in the business of selling a brand, 2) they engage in …

Read moreThe 3 Ways an Investor Can Compromise

GuruFocus: Pick the Winners First – Worry About Price Second

“There are 3 ways an investor can compromise:

1. He can compromise by paying a higher price than he’d like to

2. He can compromise by buying a lesser quality business than he’d like to

3. He can compromise by not buying anything when he’d rather own something

You could use these 3 compromises as a test of what kind of investor you are.

A growth investor – like Phil Fisher – compromises by paying a higher price than he’d like. He won’t compromise on quality. So, he has to compromise on price. A value investor – like Ben Graham – compromises by purchasing a lower quality business than he’d like. He won’t compromise on price. So, he has to comprise on quality. Finally, a focus investor – like me – compromises by not owning any stock when he’d much rather be 100% invested.”

GuruFocus: Pick the Winners First – Worry About Price Second…

Read moreOver the Last 17 Years: Have My Sell Decisions Really Added Anything?

I get a lot of emails from people saying that my strategy has changed – I’ve become more of a growth investor and less of a value investor – over time.

It’s true that the investments I’ve made in recent years have definitely changed.

But, my philosophy has changed less than it would appear from my stock picks. I concentrate heavily and go where I see opportunities I consider “nearly certain” rather than being the highest return opportunities based on pure probabilities.

There is, however, one area where my philosophy really has changed:

I’m convinced that I should simply hold stocks indefinitely.

Why?

Let’s start with two spin-offs I bought. One spin-off happened 2 years ago. The other spin-off happened a little over 10 years ago.

First, the 2-year-old spin-off. I have 25% of my portfolio in BWX Technologies (BWXT). I bought that as part of a spin-off from Babcock & Wilcox. The stock has returned more than 30% a year in the two years since the spin-off. It now trades at a P/E of 26. Normally, this is when a value investor would sell the stock. However, I think the company can grow earnings per share by 10% a year for the next several years. I also think a company of this quality should always trade at a P/E no less than 25. So, with no new ideas that seem more likely to deliver returns of 10% a year or better – I have no intention of selling BWXT. With the catalyst from the spin-off gone and the P/E above 25 – no value investor would keep holding this stock. But I intend to. Does that mean I’m not a value investor?

It might mean that. But, it also may just mean I learned from the last spin-off I liked a lot.

About ten years ago, I picked a spin-off called Hanesbrands (HBI). Here’s a quote from a roundtable discussion I did back in 2006 (share prices are not adjusted for subsequent splits):

“However, there are many situations (and here is usually where you find some bargains) where the EV/EBIT measure is not the most useful. When I can predict a high free cash flow margin with confidence, I use a very long-term discounted cash flows calculation. For instance, this is what I would do with Hanes Brands which was recently spun-off from Sara Lee. On an EV/EBIT basis, it may not look cheap. But, looking truly long-term, I’m convinced the intrinsic value of each share is much closer to the $45 – $65 range than the roughly $23 a share at which it now trades. But, that’s a special case – Hanes is a special business.”

I gave that quote back in October of 2006. Hanesbrands stock has compounded at 12% a year in the 10 years since I made that comment (it’s compounded at 15% a year since the actual spin-off date).

…

Read more