Zooplus

Zooplus

Guest write-up by Vetle Forsland

Introduction

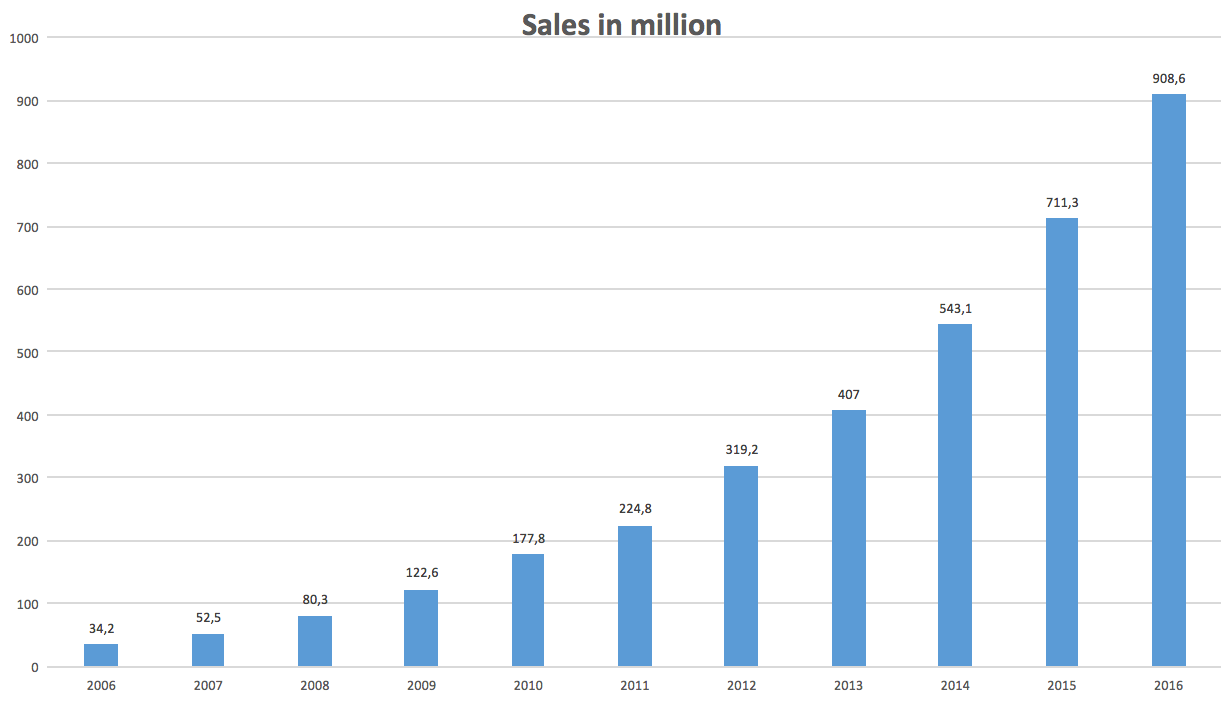

Zooplus is the leading online pet food retailer in Europe. It has on average grown sales 38% annually since 2006 (IPO in 2008) and annualized sales growth since 2010 is a 31%. In 2016 sales grew by 28%, to 908 million EUR, and there is room for additional expansion. Generally, the retailer with lowest prices and best customer service will come out as the industry leader. I believe this will be Zooplus. Lower prices and good customer service will lead to a high customer retention rate, the latter being at 92 % today. At the same time, this is a company with a lot of room for future growth, good financials and no debt.

Since its foundation, Zooplus has grown to become the clear leader in online pet supplies in Europe. The company also ranks number 3 in the overall European market for pet supplies after Fressnapf and Pets at Home. As Zooplus grows, it will become more cost efficient through economies of scale. More revenue will justify building distributing centers, which will bring the depressed margins today upwards, and create a good profit for shareholders.

Zooplus was formed in 1999, and has been operating in the pet market for more than 17 years, and on the way launched their business model in 30 countries. Pet supplies is a big segment of the European retail industry. In 2016, gross sales of pet supplies added up to around 26 billion EUR. Because of higher populations and more pets in the majority of countries, I expect this figure to continue growing over the years. Furthermore, Europe is expected to see considerable growth in online retailing, which will propel Zooplus’ sales momentum.

Pet supplies is not a cyclical industry. Sure, people will try to avoid high-end pet food brands in economic downtrends – but unless they want Kitty to starve, pet food will forever be in high demand. I believe Zooplus is in a good position to make money from these facts.

Online groceries have not lived up to the potential they once were estimated to have, so why do I think customers will shift to online pet supplies in the future? (only 6.8% of pet supplies are sold online). First of all, our beloved pets need food just as much as we do. As pet food has a (very) long expiration period, pet owners will want to buy it in bulks for lower prices – to make sure they’re never out of food for the little ones. That’s how my parents (and I) buy pet food in Norway. However, in brick and mortar stores, it is problematic for customers to buy in large bulks, since they actually have to carry the bags from the store and home. Additionally, Europeans live in dense and urban areas, where public transportation/walking is more common, making it even more difficult to buy pet food in bigger bulks.

The online pet food segment has solved this …

Read more