IEH Corporation (IEHC): May Be a Good, Cheap Stock – But, Definitely in the “Too Hard” Pile for Now

As this is an initial interest post, it’ll follow my usual approach of talking you through what I saw in this stock that caught my eye and earned it a spot near the top of my research watch list – and then what problems I saw that earned it a low initial interest score.

I’ll spoil it for you here. IEH Corporation (IEHC) is a stock I’m unlikely to follow up on because of the difficulty of digging up the kind of info that would make me confident enough about a couple key problem areas I’ll be discussing below.

I think I have a pretty biased view of this stock. Or, at least, some of what I’ll be discussing in this article might give you a negative, biased impression of the stock. And there are actually a lot of good things here. So, I’d like to start by linking to some bloggers who have discussed this stock in-depth in a way that’s different from some of what I’ll be focusing on here.

I recommend you read theses posts:

“My Trip to the IEHC Annual Meeting” – Bull, Bear and Value (2014)

“Why I Bought IEHC” – Bull, Bear and Value (2013)

“IEH Corporation (IEHC)” – OTC Adventures

“IEH Corporation: A Tiny Company with the Potential for a Big Dividend” – Weighing Machine (2013)

“Recent Numbers at this Company Say Buy, Hand over Fist” – Dylan Byrd (2015)

“IEH Corp (IEHC)” – Value Investors Club (2013)

In case you chose not to click those links, I’ll give you a quick explanation for why I might be interested in this stock at first glance.

It’s Overlooked

The stock is overlooked. I manage accounts that focus on “overlooked” stocks.

This stock has a $40 million market cap – of which, probably close to 50% doesn’t actually trade (it’s owned by insiders, etc.). So, we’re talking about a “float” of about $20 million or $25 million. Something quite small.

The company also does something quite boring. It makes connectors which go into products assembled by defense contractors serving the military, space, and aerospace industries. Investors would know the end products this company’s output goes into – Boeing 737, Airbus A380, F-35, Apache AH-64, Hubble Telescope, etc. And investors would know the customers who buy connectors from IEH – Raytheon, Northrup, Honeywell, Lockheed, NASA, etc. But, neither the company itself nor the products it produces would be high visibility to investors. I find this tends to make it more likely a stock is overlooked. For instance, in the movie industry – investors would focus immediately on the theater owner, the studio producing the film they’re watching, etc. and less on the companies that make the theater’s sound systems, digital projectors, etc. or provide the ticketing kiosks or run the theater’s loyalty program.

In this way, IEH Corporation could be something like George Risk (RSKIA) – a company that has a market cap of under $50 million, is about half owned by insiders (so, the …

Read more

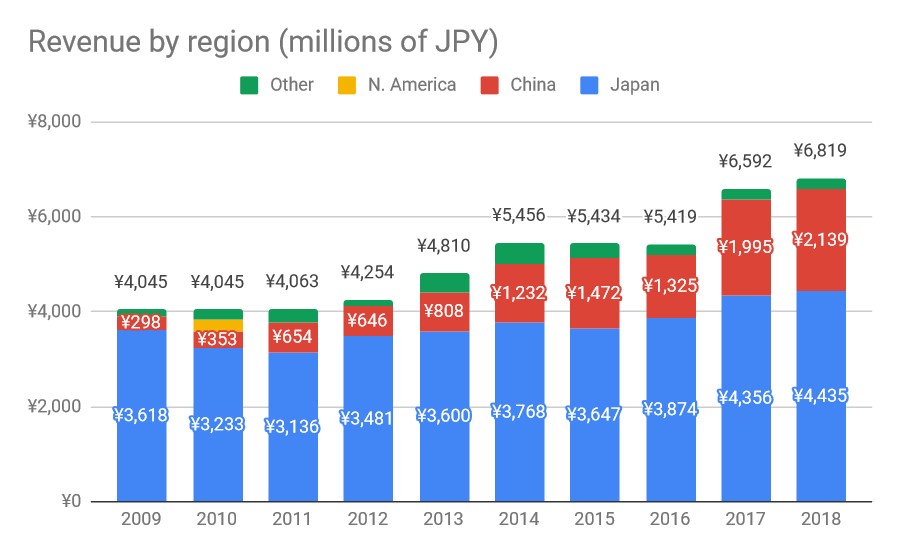

Source: Company filings

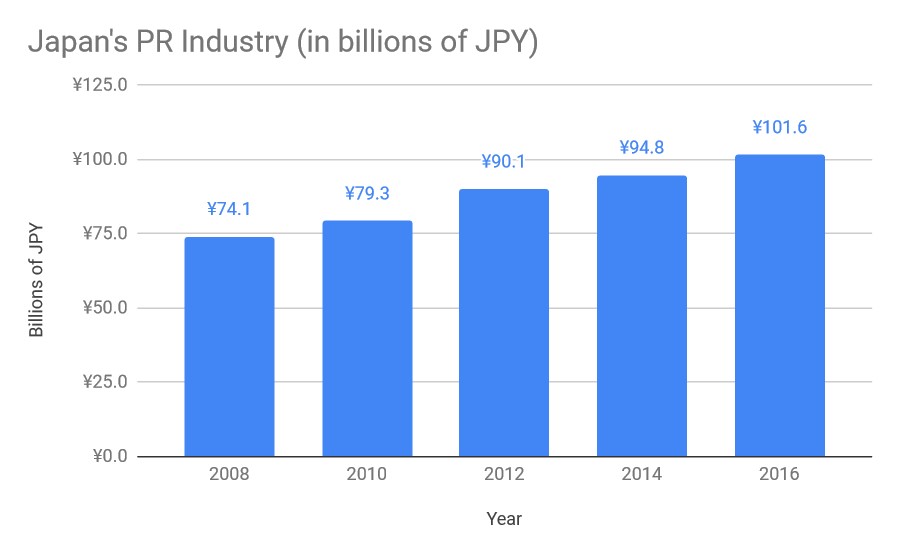

Source: Company filings Source: Public Relations Society of Japan

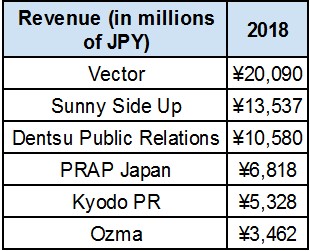

Source: Public Relations Society of Japan Source: Company websites

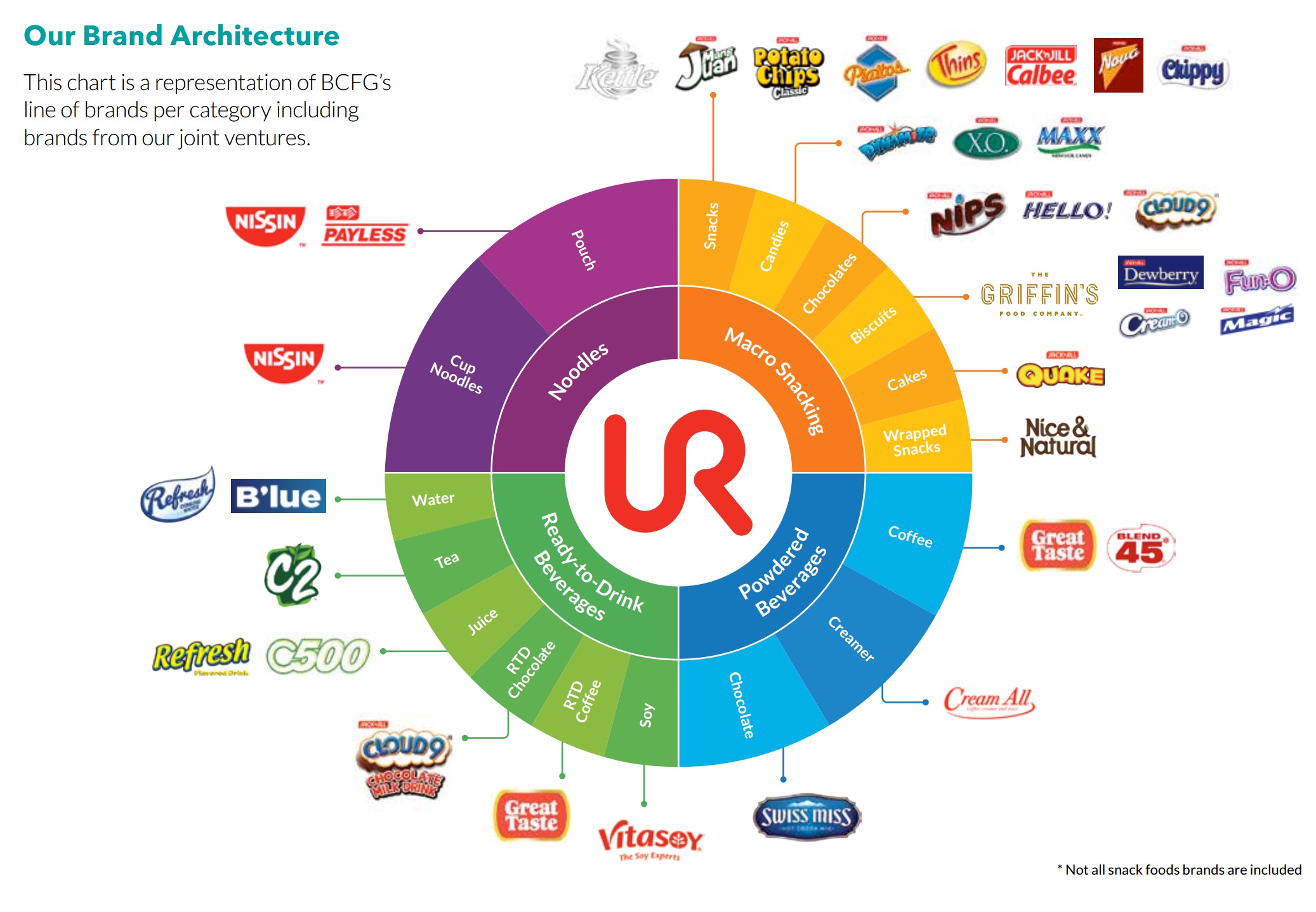

Source: Company websites In addition to its home market, URC also has presence in 12 other countries in Southeast Asia and Oceania. Its major international markets include Vietnam, Thailand, Indonesia, Australia and New Zealand.

In addition to its home market, URC also has presence in 12 other countries in Southeast Asia and Oceania. Its major international markets include Vietnam, Thailand, Indonesia, Australia and New Zealand.