DHI Group (NYSE: DHX)

This will be short and sweet.

DHI Group (NYSE: DHX) is the parent company of subsidiaries that are engaged in online career sites and services. Think indeed.com or monster.com. Their major platforms (assets) are Dice.com, ClearanceJobs.com, and efinancialcareers.com. The sites are more targeted to specific groups than their larger competitors with dice.com being geared towards technology/software professionals and the other two, I’m sure you can guess.

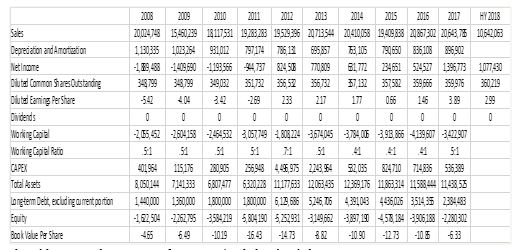

The company’s performance over the last decade has been less than stellar. Ten years ago today, the stock price was at $6.40/share. It reached a peak of $18.75/share in 2011 and has since, steadily tumbled to its $1.85/share price today (all while the job market has boomed and their competitors have grown larger). Naturally, this has drawn the attention of activists.

Most recently, on May 25, 2018, TCS Capital Management filed a 13D, announcing that they had purchased 9.7% of the total shares. On August 23,2018, they released a scathing Letter to the Board, reprimanding them for the usual: terrible performance compared to S&P and peers, bad strategy, enriching themselves at the cost of long-time shareholders, low insider ownership etc. etc.. However, the interesting part is that they publicly disclosed that they were prepared to buy the Company for $2.50/share in cash (a 25% premium to the $2.00/share closing price the day before the press release). TCS closed with the ultimatum that if they didn’t accept, they’d start a proxy battle next year (2019) to campaign for seats. They closed the letter telling the company to respond to the offer by September 5, 2018.

DHI’s response the next day- “The Board and Management, consistent with their fiduciary duties, plan to fully explore and respond to TCS’ new proposal. The Board and Management are committed to acting in the best interests of the Company and its shareholders and will continue to explore any opportunity to enhance shareholder value. In its review and discussions with TCS, the Company is being advised by Paul, Weiss, Rifkind, Wharton & Garrison LLP, Evercore and Arbor Advisory Group.”

The price moved up to $2.40 in the following days.

Since, no word from either side. The September 5 date has passed, and the price has moved down to $1.85/share.

Maybe there’s an expensive 2019 proxy battle on the horizon, but then again, the company is definitely worth $2.50/share to a private buyer (and probably more since they wouldn’t make an offer they thought was a bad bargain). In other words, the $2.50 price tag probably has some margin of safety baked in. At some point, there will be an update on the review and discussions.

May 2019 Call options are available for those interested.

Disclosure: I hold no position

https://www.sec.gov/Archives/edgar/data/1167167/000092189518001829/sc13d10608004_05242018.htm

https://www.sec.gov/Archives/edgar/data/1167167/000092189518002471/ex991to13da110608004_082318.htm

https://www.sec.gov/Archives/edgar/data/1393883/000095014218001796/eh1801013_ex9901.htm…