Argan (AGX): A Cheap, Cyclical Construction Company With a Ton of Cash and No Debt

MEMBER WRITE-UP BY JACOB McDONOUGH

Argan is a holding company that owns a few different businesses, but the most important by far is Gemma Power Systems (GPS). GPS is an engineering, procurement, and construction contractor and consultant. The company mostly provides services related to the construction of natural gas power plants, but also has worked on wind and solar projects in recent years. Argan acquired GPS in December 2006 for $33 million, and since then it has produced over $607 million in cumulative EBITDA. Argan has a ton of cash with no debt, and is selling at a very cheap price based on historical earnings. Also, the company doesn’t require any capital to operate. However, there is a lag time in between projects, which will lead to poor results over the next few quarters.

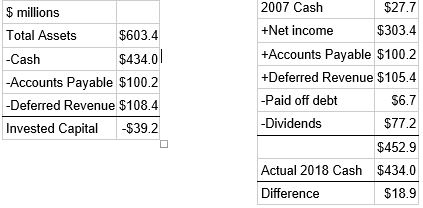

Invested Capital

In most cases, Argan can operate with negative invested capital. When projects are in process, the business is funded through accounts payable and deferred revenue. In the most recent 10-K from January 2018, the company had total assets of $603.4 million, and cash of $434 million. As long as the company has new business coming in, this cash is not needed for operations. Accounts payable was $100.2 million, and deferred revenue was $108.4 million. If we subtract these items from total assets, this comes to a negative figure of -$39.2 million. If you include the accrued expenses and long term deferred taxes, the invested capital figure becomes even more negative. This is important because the profits Argan generates becomes cash for owners, even when the business is growing rapidly. In 2007, Argan had cash of $27.7 million with $6.7 million in debt. Since then, the company has produced net income of $303.4 million. If you add up the cumulative net income, the 2018 accounts payable and deferred revenue, then subtract the cumulative dividends paid and reduction of debt, this gets us within $18.9 million of the actual ending cash balance in 2018, which is pretty close. The remainder can mostly be explained by acquisitions over the years.

In most businesses, owners must invest money in order to grow. Argan’s cash was able to build up on the balance sheet even during a period of rapid growth. Sales in 2008 were $206.8 million compared to $892.8 million in 2018, which is a compound annual growth rate of 15.8%. The company had a net loss of $3.2 million in 2008, compared to net income of $72 million in 2018. The accumulation of cash during a period of such growth is proof of the low capital requirements of the business.

High Uncertainty and Volatility Ahead

With so much cash on the balance sheet and zero debt, the risk of the business failing is very low. However, the company’s near-term future is uncertain. GPS finished some large projects this year, and will have a lag time before new projects begin in 2019. This lag time will cause the company to have a few rough quarters coming up. The …

Read more