ServiceMaster (SERV): Terminix is a Wide Moat Serial Acquirer of Pest Control Companies That’s Well Worth Adding to Your Watchlist

by JONATHAN DANIELSON

ServiceMaster spun-off their home warranty segment, principally the American Home Shield brand, under the new corporate guise “frontdoor, inc.” back in October of 2018. This spin did not garner a lot of attention from the value investing community as both the RemainCo (SERV) and the NewCo (FTDR) were easily discernible high-quality businesses and both parts were going to be about the same size business at about $1.5 – $2 billion in revenue. In other words, not particularly fertile grounds for a mispricing and not what most event-driven value investors look for. Now that we’re about 7 months post-spin, with both entities trading at high-teens EBITDA multiples, they both appear fully valued by my eye. There was quite a bit of volatility in between, as Q4 proved to be a particularly hostile environment for spin-offs of all shapes and sizes so it was possible to pick both up at bargain prices (for the quality of the businesses) if you were paying close enough attention – not so much at today’s prices.

So Why Am I Looking?

Despite ServiceMaster and frontdoor not appearing quantitatively cheap on valuation metrics, the reason I think it’s worth studying up on both companies is fairly simple. Both, at first glance, appear to be extremely attractive companies as they each dominate their respective markets and possess especially compelling corporate-level economics. I’ll go over the multitude of reasons it appears to me ServiceMaster is an above-average business in this write-up. Furthermore, it certainly does not take neck-breaking, earth-shattering primary analysis to ascertain that we’re in the late stages of the current cycle. As such, now seems as good a time as any to be adding quality-type businesses trading at quality-type business prices in order to capture the opportunity if a broader market sell-off emerges. As such, let’s start with ServiceMaster.

Overview – The Company Has Been Around A Long, Long Time

ServiceMaster has been around since the late 1930s. Granted, this is somewhat in name only as the company has acquired and divested many businesses over the ensuing decades; although, the business has always operated in the cleaning residential services industry. The company was originally founded as a mothproofing business by Marion Wade – a minor league baseball player at the time. The company quickly switched gears and got into the carpet cleaning business in the 1930s. ServiceMaster experienced a good deal of success throughout that decade and began franchising its brand in the 1940s for residential and on-site carpet cleaning. Throughout the 1960s and 1970s – the era which the ServiceMaster brand really become a household name – ServiceMaster expanded into hospital maintenance. By the mid-1970s ServiceMaster had sold in excess of 1,000 franchise licenses in its consumer cleaning division, and the Company’s health care division had won cleaning contracts with more than 460 hospitals and was growing rapidly. By the mid-1980s with hospitals reducing their budgets to implement cost controls as well as government regulations making it a continually less appealing …

Read more

This miniature is a Primaris Space Marine. Space Marines are GW’s single most iconic creations – armies of elite, genetically engineered superhumans wearing power armour and dedicated to defending humanity in a hostile galaxy filled with forces bent on humanity’s destruction. The full GW model range is simply vast though, which you can get an idea of by visiting the company’s web pages at

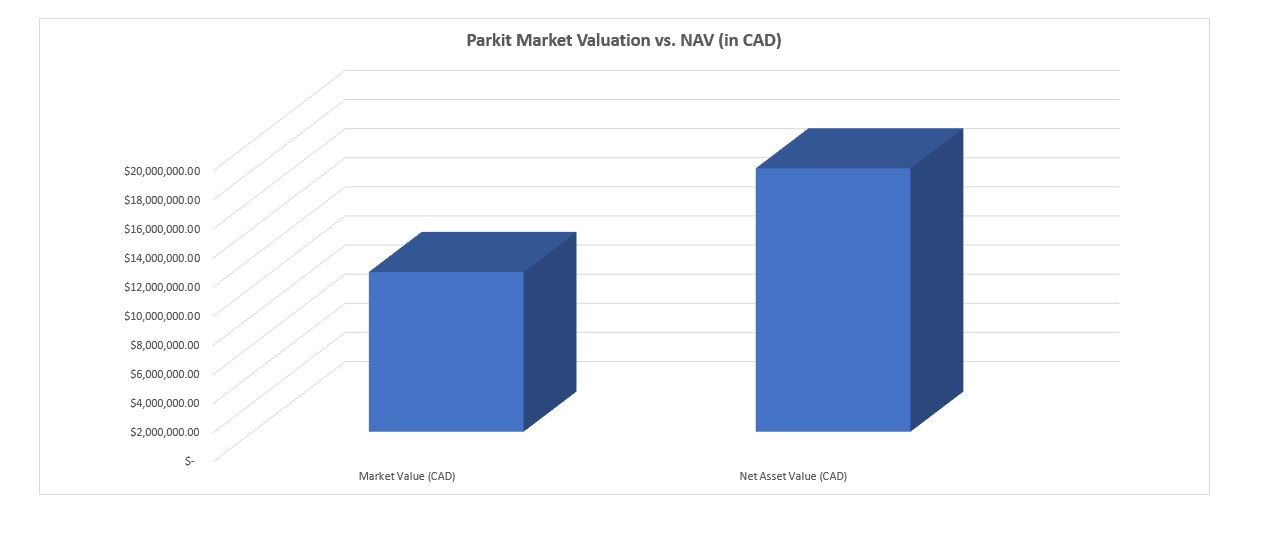

This miniature is a Primaris Space Marine. Space Marines are GW’s single most iconic creations – armies of elite, genetically engineered superhumans wearing power armour and dedicated to defending humanity in a hostile galaxy filled with forces bent on humanity’s destruction. The full GW model range is simply vast though, which you can get an idea of by visiting the company’s web pages at  (Image Created by the Author; Data via Parkit Investor Relations Page and Author’s Calculations)

(Image Created by the Author; Data via Parkit Investor Relations Page and Author’s Calculations) (Source: Parkit Investor Presentation, April …

(Source: Parkit Investor Presentation, April …