Truxton (TRUX): A One-Branch Nashville Private Bank and Wealth Manager Growing 10% a Year and Trading at a P/E of 14

by GEOFF GANNON

Truxton (TRUX) is an illiquid, micro-cap bank stock. TRUX is not listed on any stock exchange. It trades “over-the-counter”. And it does not file with the SEC.

The bank has two locations (one in Nashville, Tennessee and one in Athens, Georgia). However, only one location (the Nashville HQ) is actually a bank branch. So, I’m going to be calling Truxton a “one branch” bank despite it having two wealth management locations.

The company doesn’t file with the SEC. But, it is not a true “dark” stock. It has a perfectly nice website with an “investor information” section that includes quarterly earnings releases.

Still, if Truxton doesn’t file with the SEC – how can I find enough information to write an article about it?

Truxton – as a U.S. bank – does file reports with the FDIC even though it doesn’t file with the SEC. So, some of the information in this article will be taken from the company’s own – very brief – releases to shareholders (which are not filed with the SEC) while other information is taken from the company’s reports to the FDIC. Truxton also puts out a quarterly newsletter that sometimes provides information I might talk about here. Those 3 sources taken together add up to the portrait of the company I’ll be painting here. Some other info is taken from Glassdoor, local press reports, etc. But, that’s mostly just color.

So, it is possible to research Truxton despite it being a stock that doesn’t file with the SEC.

But, is it possible to actually buy enough Truxton shares to make a difference to your portfolio?

It depends. Are you an individual investor or a fund manager? Do you have a big portfolio or a small portfolio? And – most importantly – are you willing to take a long time to build up a position in a stock and then hold that stock pretty much forever?

No shareholder of any size would have an easy time getting out of Truxton stock quickly. But, if you intended to stick with the company for the long haul – it is possible, if you take your time buying up the position, for individual investors to get enough TRUX shares.

The math works like this…

Truxton shares are illiquid but not un-investable. In an average month, there might be around $300,000 worth of shares trading hands. Let’s round that down to $250,000 to be conservative. Let’s say you can buy 20% of the total volume of shares traded in a stock without much disturbing the price. That’s one-fifth of $250,000 equals $50,000. So, let’s say you can put $50,000 a month into Truxton stock without anyone noticing. That’s $150,000 per quarter, $300,000 every six months, and $600,000 over a year. Most investors don’t put much more than 10% of their portfolio in a single stock. So, if you’re willing to take up to a year to buy it – Truxton is investable for anyone with an account of …

Read more

This miniature is a Primaris Space Marine. Space Marines are GW’s single most iconic creations – armies of elite, genetically engineered superhumans wearing power armour and dedicated to defending humanity in a hostile galaxy filled with forces bent on humanity’s destruction. The full GW model range is simply vast though, which you can get an idea of by visiting the company’s web pages at

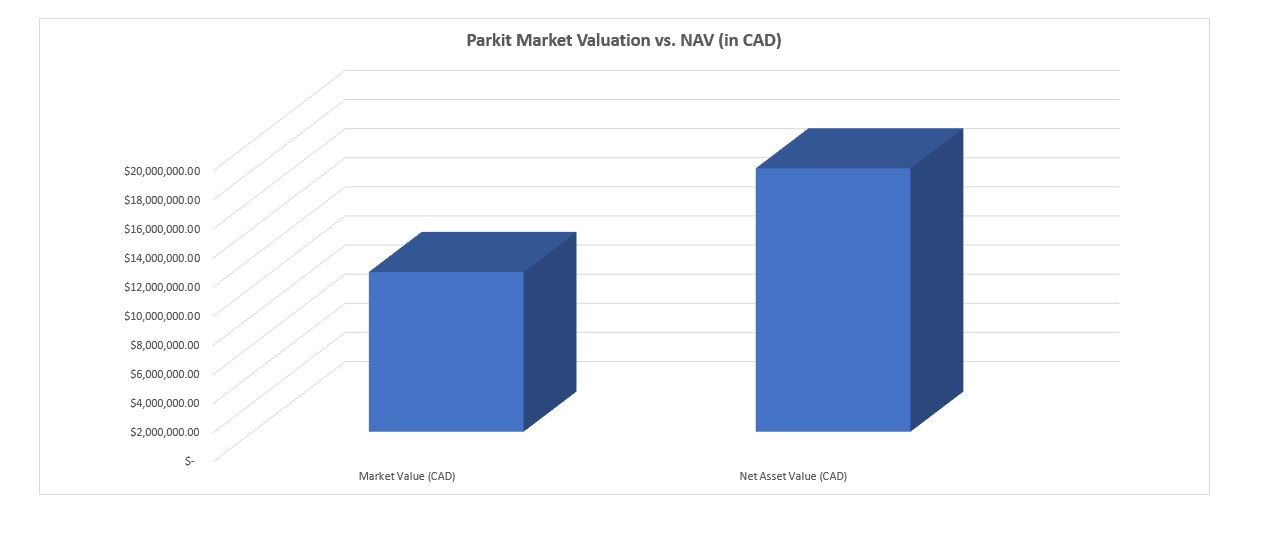

This miniature is a Primaris Space Marine. Space Marines are GW’s single most iconic creations – armies of elite, genetically engineered superhumans wearing power armour and dedicated to defending humanity in a hostile galaxy filled with forces bent on humanity’s destruction. The full GW model range is simply vast though, which you can get an idea of by visiting the company’s web pages at  (Image Created by the Author; Data via Parkit Investor Relations Page and Author’s Calculations)

(Image Created by the Author; Data via Parkit Investor Relations Page and Author’s Calculations) (Source: Parkit Investor Presentation, April …

(Source: Parkit Investor Presentation, April …