OTC Markets Group (OTCM): A Far Above Average Quality Company at a Fair Enough Price

Member Write-up by PHILIP HUTCHINSON

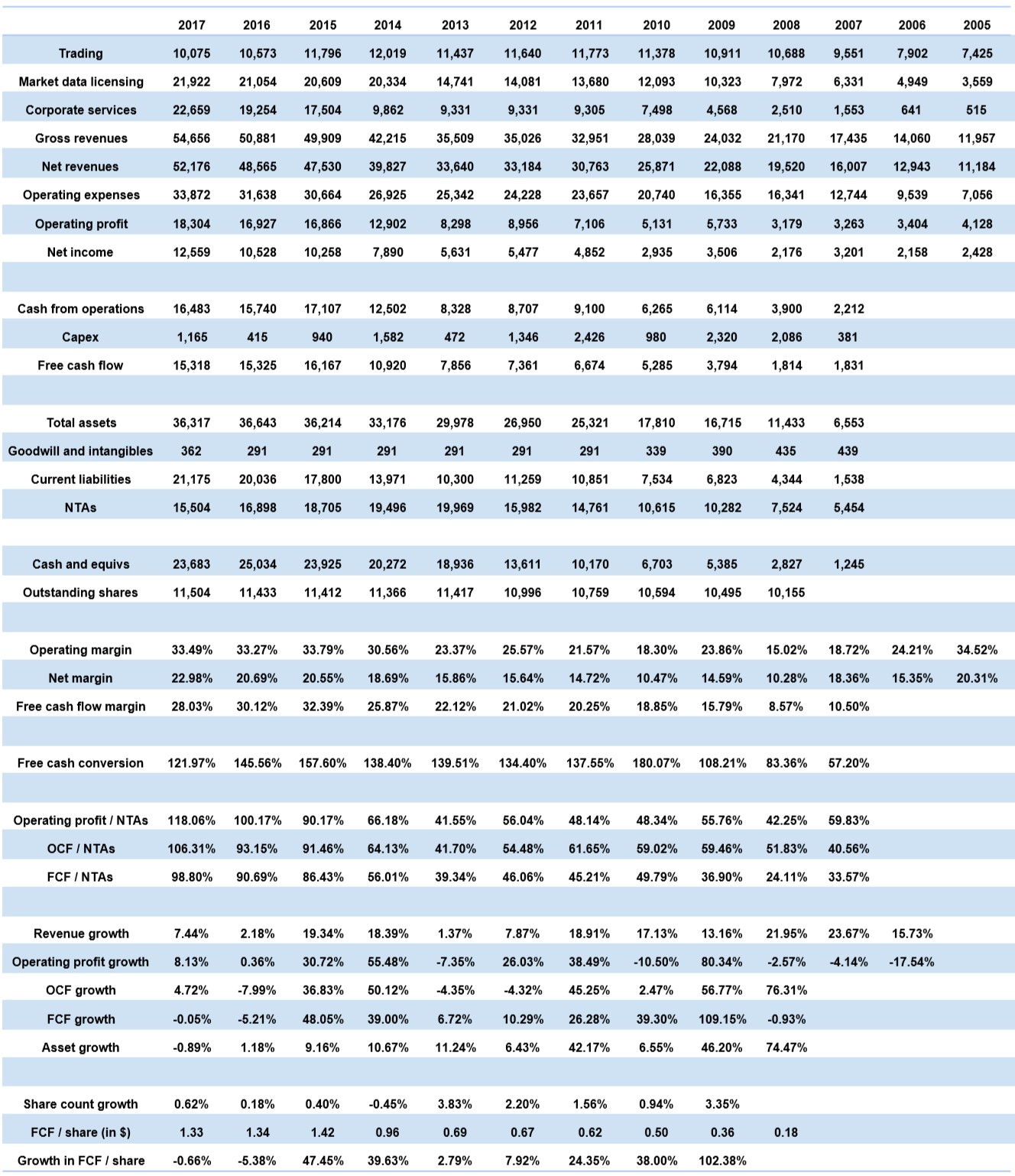

| Company | EV / Sales |

| LSE | 8.5x |

| Deutsche Borse | 8.3x |

| Euronext | 7.3x |

| BME | 6.2x |

| CBOE | 10.9x |

| ICE | 8.1x |

| OTCM | 5.7x |

Overview

Many of you will be familiar with the concept of over-the-counter (“OTC”) stocks. OTC Markets Group is the owner and operator of the largest markets for OTC stocks in the U.S. The company trades on its own OTC market under the ticker “OTCM”. You can find its financial releases, earnings call transcripts and other disclosures at the following link:

https://www.otcmarkets.com/about/investor-relations

And for purposes of full disclosure, OTCM is a stock that Andrew and Geoff hold in the managed accounts they run. The analysis here is, however, entirely my own. It’s not Geoff’s thoughts on the company.

OTCM was originally founded in 1913 and has, for many decades, published the prices of “pink sheet” OTC stocks. It has been run by its current CEO, Cromwell Coulson, since a buyout in 1997, under whose management it has digitised its business and standardised the structure of the OTC markets, while still remaining focused on the operation of OTC stock markets in the U.S.

Established stock market operators such as CBOE, NASDAQ, Intercontinental Exchange Group (“ICE”) (the owner of the NYSE), LSE, Deutsche Börse and Euronext, are all fantastic companies. However, they are in many cases much more diversified than OTCM. Take the LSE. It is undoubtedly a great business. However, it is also very diversified geographically and by business line. It owns the London Stock Exchange and Borsa Italiana. But, it also has a big business in clearing of other financial instruments, as well as owning the “Russell” and “FTSE” series of indices. It is today a much broader business than just a stock exchange.

The exchanges listed above are all good businesses. In OTC Markets, however, you can find a lot of the same financial and economic characteristics, but in a much smaller, more illiquid, more focused company, run by a CEO who is also by far the largest shareholder in the company.

OTCM originally used to simply publish prices of OTC stocks in a paper “pink sheet” publication distributed in a manner similar to old style Moody’s manuals. Under Coulson’s leadership, the company has overhauled its business, creating tiered markets for OTC stocks, with three different designations – the highest quality, most stringent, OTCQX market, the OTCQB “venture” market, and finally the pink sheets for all other OTC stocks. OTCM earns subscription revenues from all companies on the OTCQX and OTCQB markets, but not from any stocks on the pink sheets. It has turned itself from a publisher of stock prices to a standard setter, aggregator, and provider of data and trading services that is the owner of the leading OTC stock market in North America.

Unlike the competitors listed above, OTCM is not, technically, a stock market. The precise distinction between an OTC stock and a listed stock, and between the nature of …

Read more