Parkit Enterprise: Activist Controlled Parking Lot Owner Looking to Monetize Holdings, Trading at a Discount to Net Asset Value

WRITE-UP BY THOMAS NIEL

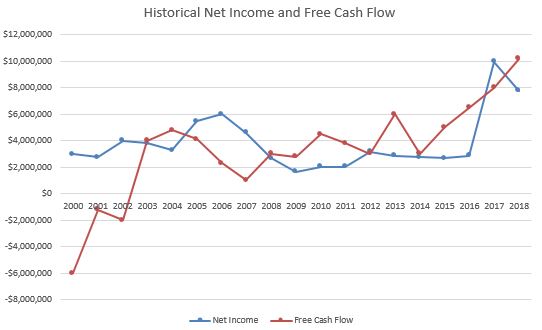

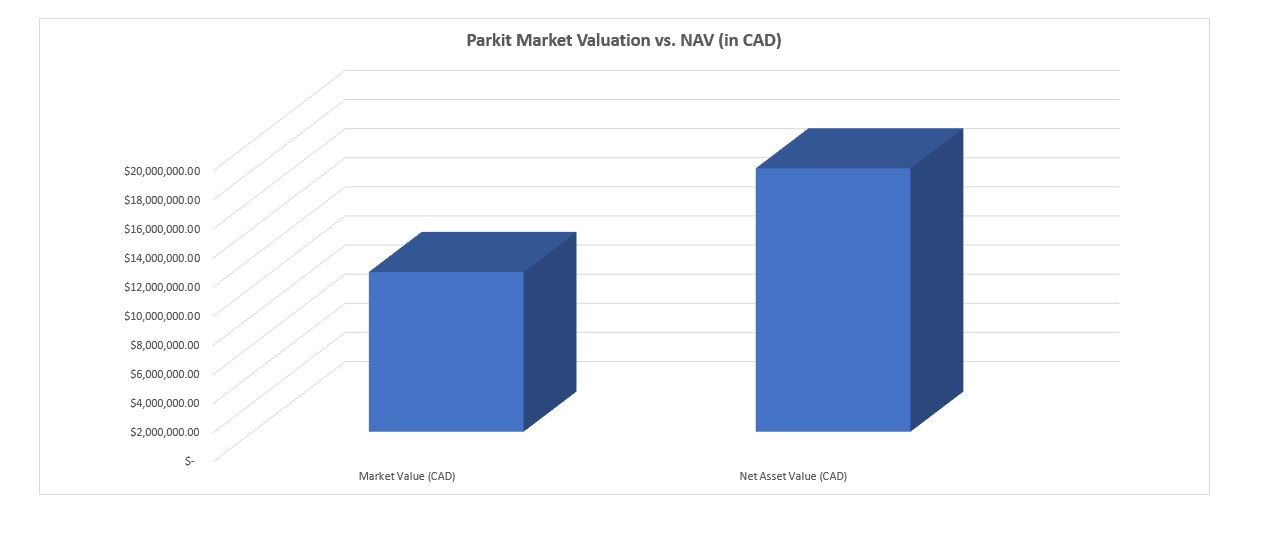

(Image Created by the Author; Data via Parkit Investor Relations Page and Author’s Calculations)

(Image Created by the Author; Data via Parkit Investor Relations Page and Author’s Calculations)

Parkit Enterprise is a Canadian-domiciled owner of parking lots in the United States.

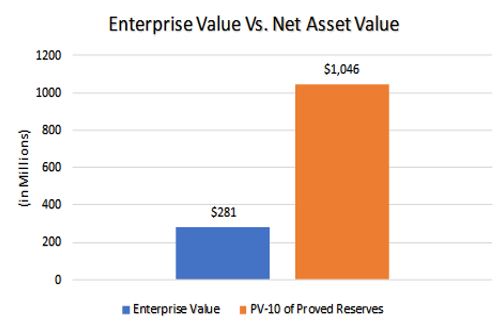

Investors have forgotten about Parkit, pushing the stock to trade well below its underlying value.

But one investor saw opportunity and has taken the reins to realize the company’s underlying value. Leonite Capital, a family office led by Avi Geller, has acquired a large position, and last year took control of the board.

Following this proxy-fight win, Leonite is looking to extract full value out of the company. But can they achieve what its prior management presumably failed to accomplish? Will realization of full value occur within an attractive timeframe (2-3 years?).

Let’s take at Parkit and see if the current discount to NAV is justified or presents a strong investment opportunity.

Background

Parkit Enterprise, Inc. (TSX.V: PKT; OTCQX: PKTEF) is a Canadian-domiciled owner of parking lots in Colorado, Connecticut, and Tennessee. The stock trades on the Toronto Venture Exchange, as well on the US OTC markets.

Parkit started out as Greenscape Capital Group, a holding company engaged in various “green”-related businesses. After developing the Canopy Airport parking facility, the company decided to sell off its non-core holdings and focus entirely on parking.

The company renamed itself Parkit Enterprise in 2013. Starting in the mid 2010s, Parkit formed a partnership with parking lot management company Propark America to acquire additional properties.

This resulted in Parkit becoming a major investor in two partnerships:

- OP Holdings JV, LLC. This partnership was formed in 2015 with Och-Ziff Real Estate as the primary investor. In 2015, OP acquired Parkit’s Colorado property, as well as properties in California, Connecticut, and Florida.

- PAVe Nashville, LLC. a 50/50 partnership with Propark. This vehicle acquired an airport parking facility in Nashville, TN in 2015.

This opaque ownership structure is part of the reason why investors have overlooked Parkit. Like with other similar vehicles (such as Regency Affiliates), there is the added risk of being a “passive investor in a passive investment”.

OP Holdings JV

The bulk of Parkit’s investments are held through OP Holdings JV, a partnership with Och-Ziff Real Estate and Propark formed in 2015.

Parkit owns an 82.83% interest in Parking Acquisition Ventures, LLC (PAVe). Due to the success of two divestitures, Parkit has fulfilled the 15% IRR hurdle due to Och-Ziff. As per the terms of the operating agreement, proceeds from asset sales will now begin to flow to PAVe.

As per the operating agreement, PAVe is now entitled to distributions until it realizes a 15% IRR on its initial capital contributions.

Through OP, Parkit holds interests in 4 properties:

- Canopy Airport Parking Facility (nearby Denver International Airport)

- Riccio Lot Hospital Parking (New Haven, CT)

- Chapel Square Lot (New Haven, CT)

- Z-Parking (East Granby, CT)

Canopy Airport Parking Facility

(Source: Parkit Investor Presentation, April …

(Source: Parkit Investor Presentation, April …